Living in the digital age has brought great convenience to people’s lives. Thanks to rapid technological development and having easy access to information, people have become more independent and self-reliant.

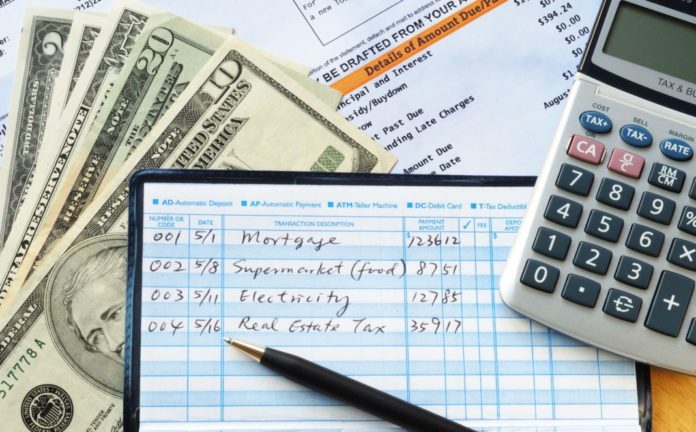

This also applies to personal money management and financial planning.

Whether it’s making a budget, doing taxes, making a retirement plan, thanks to technology and financial tools, it has become relatively easy for anyone to manage money on their own. Yet, that doesn’t always mean it is going to be successful.

Just like with any profession that requires a set of skills or knowledge and expertise, a lot of research and learning is needed for mastering personal finance management. For some, it might be easy and effortless, and for others, it can be time-consuming and not worth the effort.

Your financial goals and responsibilities become more complex the older and busier you get, and that is why it is a good idea to consult a financial advisor. They can give you advice and guidance on how to deal with a wide range of issues and obligations from planning and savings to taxes, investments, and insurance.

Here some reasons why hiring an expert is beneficial when it comes to your personal finance.

1. Expertise

Since they are certified professionals, financial advisors have a much broader and deeper knowledge of money management and planning. This is particularly useful when dealing with more complex financial matters like savings and investments.

If you need advice and guidance on any kind of financial planning, these experts can help you come up with and choose the best savings system, give you various retirement options and plans, and aid in setting up financial goals for the future.

You can click here to get more information on the expertise of financial advisors.

2. Saving Time

While you might be obligated to meet with you advisor intermittently, to discuss the progress or change of your goals or the position of your investments, you won’t have to deal with adjusting your account periodically or managing your portfolio, since it is something that will be done by your financial advisor.

3. Unbiased Third-Party Opinion

As humans, we are not immune to making irrational and hasty decisions, so having an impartial third-party opinion might be crucial in preventing financial loses. They might stop you from making bad decisions or even notice an opportunity that you failed to recognize. In the end, they might be the reason for the increase in your investment returns.

4. Not Wanting to Deal With Your Money

For some, managing and planning their finances might be a difficult, time-consuming, or even impossible task. Some people might not be good at money management, especially if they lack the skills or knowledge, while others are simply too busy for it. In cases like these, hiring a financial advisor should be an easy decision to make.

While their services might be pricey, hiring a financial advisor might prove to be a smart decision in the long run. If you’re struggling with properly managing your finances, setting up financial goals, or you just want an experts’ opinion, having an advisor might be the best choice for you.