When it comes to providing your employees with useful information related to their monthly or bi-weekly earnings, there is no better way to do that than with a real paystub.

But seeing as not many people understand the concept of paystubs, we must distinguish one from another. So if you’re a newbie that wants to learn more about it, this is the article for you. With all that said, let’s start.

Difference Number 1: Incorrect Information

As you would expect, the first sign that you’re dealing with one such fake document is spotting incorrect information. Since the person in charge of this document is the company’s accountant, it’s their job to spot incorrect information such as the name, last name, occupation, and date of birth.

Also, plenty of fake paystub issuers do a poor spelling job. Since it’s also the accountant’s job to spot these mistakes, there is a very good chance that the paystub will not go through.

A real paystub, on the other hand, will not have this issue as a paystub generator will use company information related to the employee. For example, the name, last name, occupation, and date of birth will all be stored on the application that the company uses. This is done to eliminate fraud and eliminate spelling mistakes or incorrect information.

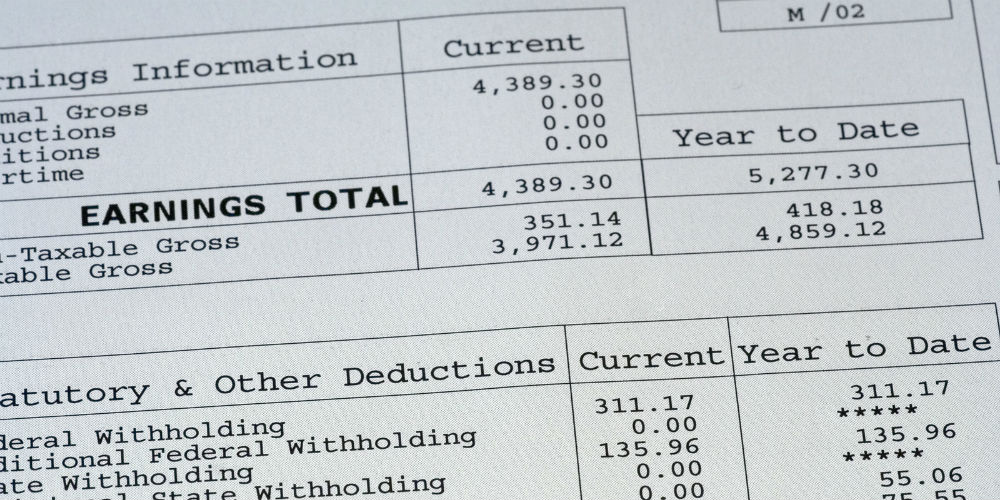

Difference Number 2: The Digits

Accountants aren’t only trained to correctly input the name and other basic information needed; they’re also trained to properly add all the digits and decimal points. Whenever dealing with a fake document, chances are it won’t look as professional as it should. There are some pretty excellent paystub generators that hundreds of thousands of companies use to issue their employees with real paystubs.

Fake ones, on the other hand, look poorly done and this is especially the case when it com

es to inputting the digits. Real paystubs follow the lead of professional accounting software since accuracy is of high importance when issuing such documents.

Difference Number 3: Rounding Up

We tend to round up numbers as they’re more convenient for calculating. But that isn’t the case in the financial world. In this world, rounding up usually points out malicious schemes as $489 doesn’t mean $500.

Whenever you see numbers rounded up on one such document, then there might be a case of using a fake. Most employees that get issued real paystubs will tell you that the numbers never come rounded up.

There is always a decimal or a single dollar that makes all the difference. As an accountant or person working in the financial sector, you should never believe a person that shows you a paystub with a perfectly rounded up NET PAY.

Real paystubs always have extra dollars and cents. And if you’re interested in issuing documents that will not round up the net pay, then make sure to visit paystubsnow. This is a perfectly handy tool that makes generating documents easy and quick.

Difference Number 4: No Difference Between 0 and O

While this might seem like a very small difference, it is no doubt a huge one. There should be a clear difference between 0s and Os and if you can see it, then do know you are dealing with a fake document. If you cannot spot it, however, then do know that zero’s should be more lengthy while Os should be more rounded.

As any professional accountant or financial person would tell you, mistakes such as these do not happen. If you do spot one, then it’s probably due to a non-financial person failing to spot the difference themselves. A real paystub made by a real company accountant will never make these mistakes.

Difference Number 5: Difficulty To Read

Considering that this document is of high importance to both the company and its employees, there should be no readability issues. Poorly written sentences and wonky formatting are usually a sign that you’re dealing with a fake document. Don’t be fooled by the lack of professionalism you see if you observe one of these.

Difference Number 6: Salaries Not Matching

Another thing to do to confirm that you’re handling a real paystub is to make sure the salary or wages match that of previous bank statements. To do that easily, just ask for a bank statement where you can confirm that both numbers are correct. This shouldn’t be hard to do as accountants and other people in finance know how to do that.

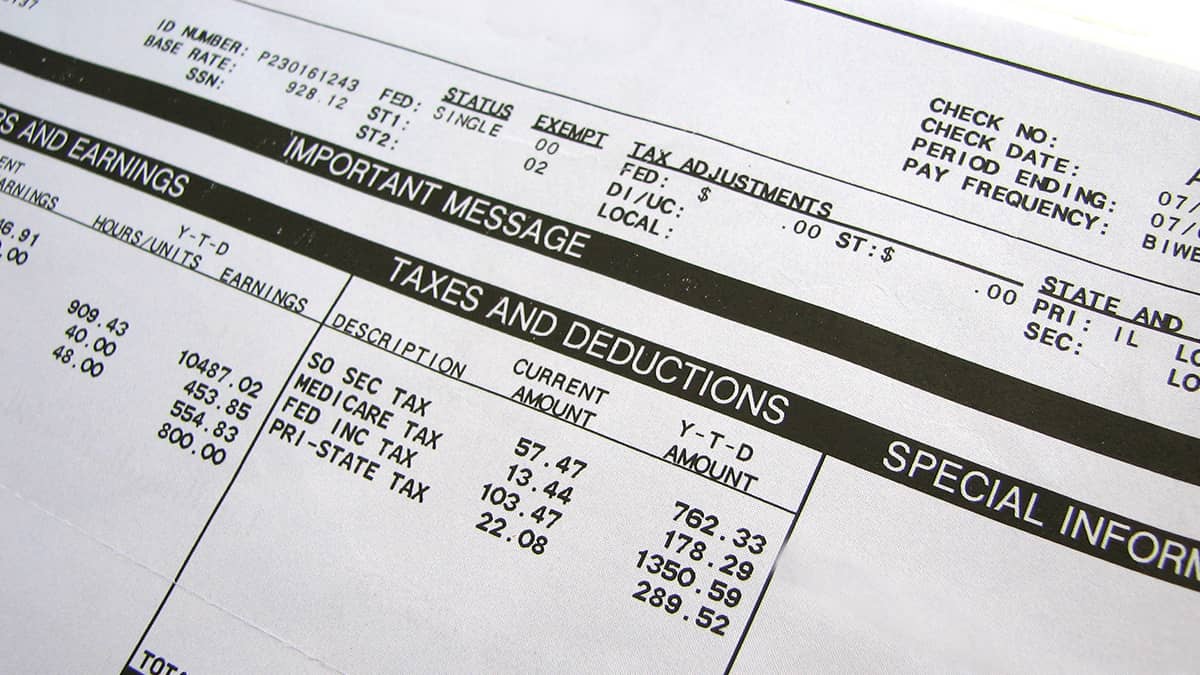

Difference Number 7: If the Math Doesn’t Add Up

To be extra sure that you’re dealing with a real paystub, all you need to do is simply do the math yourself. The area where fake documents struggle the most is calculating the earnings and deductions. There are a couple of deductions that you need to look out for when creating these.

Accountants understand this but not the people that try to fake them. As we said, all you need to do is simply do the math yourself and see if the numbers add up. If they don’t then you’ve been handed a fake document.

Why Double Checking Is Important?

Financial documents are more than pieces of paper that we use to confirm our salaries or wages. These documents serve a greater purpose that not many people understand. Real paystubs can be used whenever an employee needs to take out a mortgage or any other kind of loan. This document confirms to the banks or lenders that the person has a job and has a salary. More so, this document can be used as proof of income in various money-related situations.

These can credit checks, taking loans, buying a new vehicle, and dozens of others. Other situations exist where we would also need this document. As you would expect, employees can use this document as proof that they’ve been rightly or wrongfully paid by their employers. Since a real paystub contains information such as net pay, if you notice that the numbers don’t add up then you can use it as proof. With all that said, most inaccurate net payments are usually down to human error and not malicious activity.